Introduction

Since good health is wealth, safeguarding it also safeguards your future. Health insurance companies can help with that. They serve as a safety net for unforeseen medical expenses. But how do you choose the best insurer when there are so many to choose from? What health insurance companies do, how they operate, and what to look for before enrolling are all explained in this article.

What Are Health Insurance Companies?

Companies that offer medical expense coverage are known as health insurance companies. You pay a monthly premium to the insurer, who then pays all or part of your medical bills, rather than the entire cost of treatments.

Example:

- Surgery costs $2,000 if you don’t have insurance. If you have insurance, you may only have to pay $200; the rest will be covered by your policy.

Why Health Insurance Companies Matter

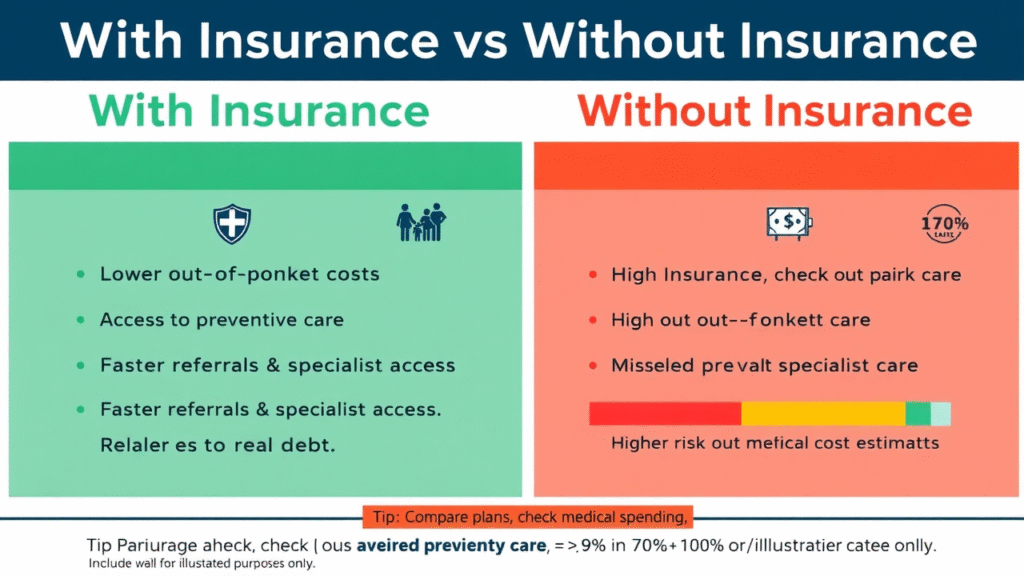

Everywhere, the cost of medical care is increasing. Thousands of dollars can be spent on even a basic hospital stay. When emergencies occur, health insurance companies make sure you don’t have to spend all of your money or incur debt.

Key Benefits:

- Financial Protection: Prevents excessive expenses.

- Better Healthcare Access: Numerous insurance companies collaborate with prestigious medical facilities.

- Preventive Care: Frequently covered are routine examinations and screenings.

- Peace of Mind: You can concentrate on getting better rather than spending money.

How Health Insurance Companies Work

Let’s simplify it by going over each step in detail:

- Each month or year, you pay a premium.

- When you need medical attention, you go to a doctor or hospital.

- Depending on your plan, the insurer may pay a portion of your bill.

- You might have to pay a co-pay (your portion of the bill) or a deductible. Key Words You Should Understand

- Premium: The monthly or annual fee you pay.

- Deductible: The amount you pay out of pocket before your insurance begins to pay.

- Co-pay: A nominal charge for medications or doctor visits.

- Network: Physicians and hospitals that take your insurance.

Types of Health Insurance Companies

Not every insurance provider is the same. They fall into the following categories:

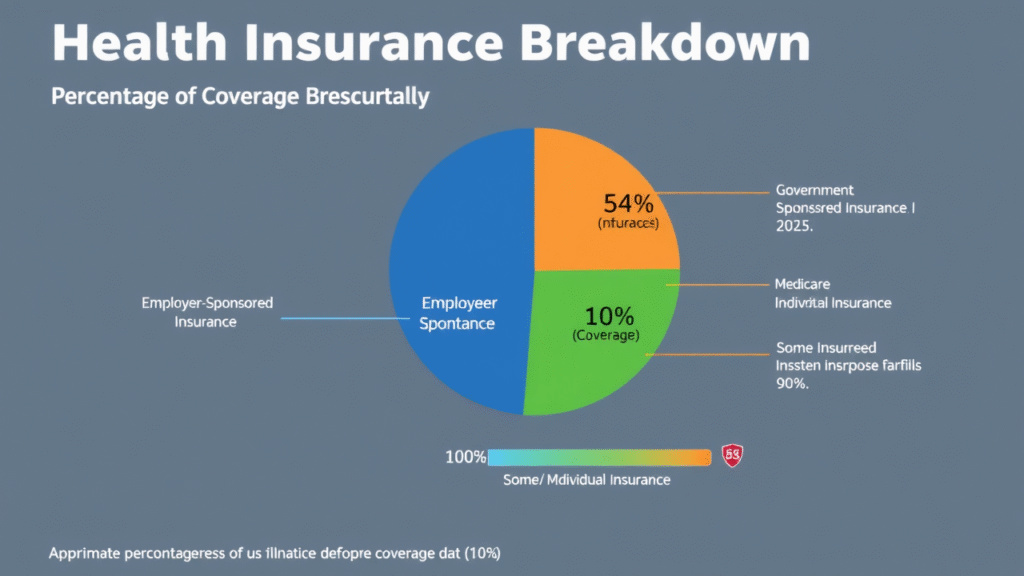

- Private Health Insurance: These companies are for-profit and provide various plans. Aetna, Cigna, and UnitedHealthcare are a few examples.

- Programs for Government Health Insurance: Public health insurance is offered by certain governments (such as the NHS in the UK and Medicare in the US).

- Employer-Sponsored Insurance: Many people obtain insurance through their jobs, where employers pay a portion of the premiums.

Top Health Insurance Companies in the World

Here are some of the largest and most trusted insurers globally:

- UnitedHealthcare (USA): One of the biggest providers with vast hospital networks.

- Kaiser Permanente (USA): Known for integrated care and customer satisfaction.

- Aetna (USA): Offers affordable plans with wide coverage.

- Cigna (Global): Popular for international coverage.

- Allianz (Europe): Strong presence in Europe and travel health insurance.

How to Choose the Right Health Insurance Company

Remember the following when choosing an insurer:

- Options for Coverage Verify whether they provide coverage for maternity care, mental health, surgery, hospital stays, and preventive services.

- Hospitals in networks You’ll have more options for hospitals and doctors if your network is large.

- Ratio of Claim Settlement This demonstrates how frequently the business settles claims. Better reliability is indicated by a higher ratio.

- Client Support Reputable insurers provide quick claim processing and round-the-clock assistance.

- Premiums and Expenses Compare the benefits and premiums. The cheapest isn’t always the best.

Common Problems with Health Insurance Companies

It’s not always easy sailing. Consumers frequently voice their complaints regarding:

- Difficult claim procedures

- Unexpected expenses and exclusions

- Annual premium increases.

- Limited networks of hospitals.

Future of Health Insurance Companies

AI and technology are making health insurance more intelligent. What to anticipate is as follows:

- Digital Claims: Online processing is quicker.

- Telemedicine Coverage: This includes virtual consultations with physicians.

- Wearable Device Discounts: Reduced premiums are obtained by tracking healthy behaviors.

- Global Plans: Simple coverage for foreigners and tourists.

FAQs About Health Insurance Companies

Q1: Are pre-existing conditions covered by all companies?

Not all the time. Before coverage begins, some have waiting periods.

Q2: Is it possible for me to change health insurance providers?

Yes, but be sure to review the transfer regulations and potential sanctions.

Q3: Are public plans superior to private ones?

Although private companies typically offer more options, government plans are typically less expensive.

Q4: What would happen if I didn’t have health insurance?

You run the risk of having to pay for expensive medical bills out of pocket.

Conclusion

Companies that provide health insurance are essential to safeguarding both your financial and physical well-being. Your needs, financial situation, and preferred type of healthcare will all play a role in your decision. Always weigh your options, pay attention to the fine print, and choose a business with a solid reputation for making claims.

Making a prudent investment in health insurance now will save you money and stress later.